The Bear is Back for the 4th Turning... Daniel Mankani

Fireworks on the Fourth of July - The Bear is Back for the 4th Turning. Firecrackers on the fourth of July. It's hard to accept the western world is now bankrupt of all credibility! It's lost the fight even before it begun. Put it in! Putin has made that happen. The Entire Ponzi has blown up.

Daniel Mankani: The Bear is Back for the 4th Turning...

About| In the Press

Lisbon / July 4th 2022. DynamicTrader.com - Trend Trading Dynamics Since 1998. All Rights Reserved.

Bitcoin is a Ponzi and Why its value is Zero.

Watch the Trends Live Here on Snapwire.com

Political Crisis is brewing in America. click for details.

Firecrackers on the fourth of July. It's hard to accept the western world is now bankrupt of all credibility! It's lost the fight even before it begun. Japan is in a JGB crisis and its currency in collapse mode, in economic stagnation due to depopulation rapidly occuring, the architech of all that fiat money system who reined over the financial markets since then with his negative interest rates policies which were the causing the collapse of japan was just shot. Revolt is in the air and Anger everywhere this time.

Put it in! Putin has made that happen.

The Entire Ponzi has blown up.

This makes the situation extremely fragile.

The Bubble of Everything has gone bust.

You know that kind of a bubble in which the forger never stops forgery till his hands are cut off.

Such a time has arrived, this will lead to only one thing, global civil disorder and riots, leading into a Massive Uprising Civil War type of environment where the leading superpower folds and its generations for millennia to bear the the sufferings which come from "Riding High Horses and then falling down" for a very long time to follow.

Such are the trends of these times.

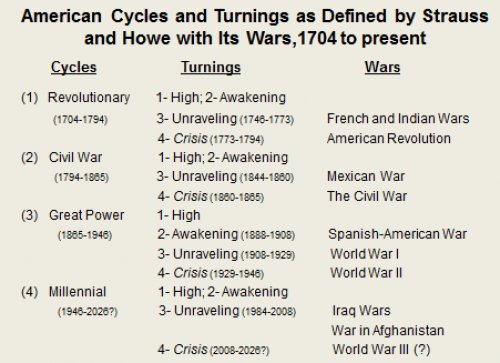

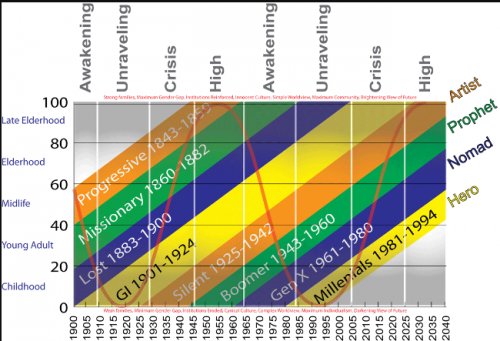

The coming Worldwide Sovereign Debt Crisis leads straight into a massive global war, the same happened two times before, high debts and a stagnating economy is a perfect recipe for disaster resulting in the 1929 great depression and world wars to follow, this two events also happen in tandem and it should come as no surprise as “when the tribes revolt give them an external enemy” has worked wonders for centuries, for religious spigots, kings and queens and now the function of administrators which we call government, their citizenry is in the end is the one who bears the greatest sufferings, for the mismanagement of their administrators, when there are gains they get favours’, a higher standard of living and a share of the loot, when it unravels they pay thrice the price.

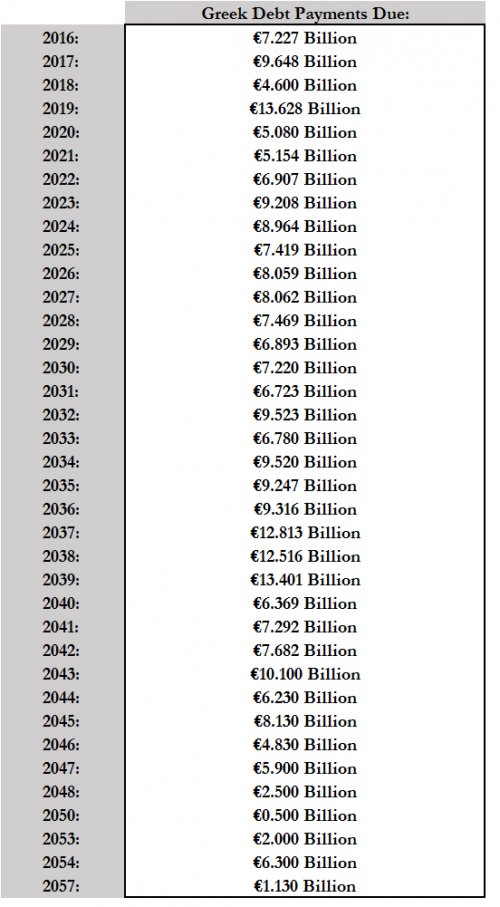

Would be good to know the numbers now. These were 2015 Estimates. Its much worst now.

Its in this America where its the cause of its own undoing, WHERE greed and WHEN corruption reings this great, the revolt has always begun. For what reason this happens, I would assume its EGO! the type which comes from "Pride Before the Fall" there are lessons from the French Revolution. The lack of any historical memory calls for repetition. Its a Cycle of Things to Become. .This is not a prediction.

Now America is doing it to itself. It made many false promises and bombed more than 50 countries in the last 50 years, its Elite used the American Military to their means for deals overseas, It’s Politicians are openly exposed in Fraud via the messages coming out of Russia and elsewhere, its losing not only creditability fast, an Internal Revolt is also well underway, where burning looting stores, breaking down old historical statues are accepted signs of protests, when infact its actually disguising riots and revolts against the establishments and its failures.

Its citizenry is split up among many self created fault lines and its losing wealth fast and experiencing growing higher and higher inflation at the same time. To me these are signs of An Empire going bust and what consequences it brings hereforth is the study of analysis here. Its going bust. Explained here.

If anything, the American Leaders have done very well is create divisions across all spectrums and they have done it in such fashion which creates many more. This in itself now makes their strategies broken and tainted, if anything is to work it will work against them. This slippery slope too is now in motion.

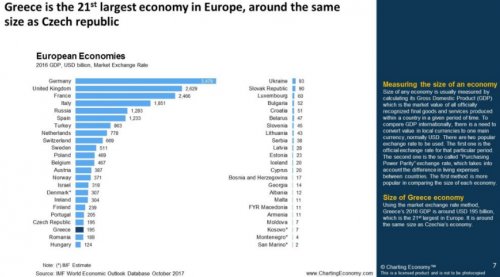

The Situation in Europe is also no different, Poverty in Developed Europe in some parts in now reaching the levels of the lesser developed zones. In Italy the data is grim and so it is in Greece, Ireland, and France. Internal Strive and Revolt is everywhere caused by the Pandemic. When we look at the pandemic it has been fabulous, one legendary trader in an Interview said “the greatest emotion in the markets is that of Envy! Nothing beats it.

Lets ask the European Union if Greece has the economic Size to Pay its Debts? How will Ukraine?

This envy has now played out exactly as it always have been, first comes jealousy then outright hate. Hating the system and hating the old relic wealth, the youth revolted first with good intentions and took on the bait of creating their own Metaverses and Means of Transactional coins, then they went a bit further and believed in their own lies and started flipping virtual lands and images, they called it Non Fungible Tokens.

While we have constantly remained consistent, these items are not of any value and the world has now seen the greatest bubble in tulips since holland. These are all going to Zero.

Facebook to pay the price of mismanagment, the entire advertising Industry is to shrink not grow. They lose users they are done all because they lost creditibility and trust of their users. People vote with their money is indeed true, Facebook targets $60.00 for losing facebook and focusing to meta which no one goes to anymore. Its last at $168 after historical high at 386. Buyers who got into the pandemic lows around 130s are now all underwater, double averaged and caught long and are trading beyond their allowed curfew time. Kids who should better stick with video games and toys ought to stay there, by moving into the stock market the everything bubbles was formed.

Am sure what comes next, you can already figure it out.

All are caught naked and wrong.

The carry away of greed has been so great that Central Banks and the entire Civilian Slaves who maintain order got distracted, the regulators got confused and some nation states adopted Worthless bitcoins as national currency, then too the system didn’t work, cause a Ponzi like a forger can only be stopped when the means to additional forgery is cut off.

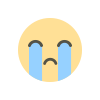

The Commodities Rally has done just that, which makes the entire situation very precarious cause an old established order is folding at the same time. The process of every great bear market has began with Envy, Greed, which then translates into Hope where we are now and it ends is total chaos and disaster where fear reigns its head most. Here are lessons of the Dot Com Bust. Chapters: Hope | Fear | Greed .

This too has happened many times before!

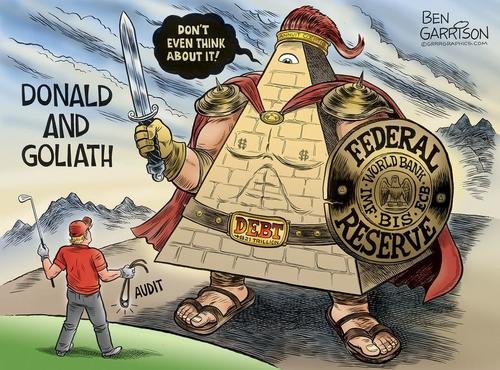

Couple this with a bear market in stocks and the collapse of Crypto, some have gotten to their knees so low they are begging for a bailout and praying to Powell to not be so aggressive with hiking rates, these are times of Hope. There isn't much powell or anyone else can do especially when they are getting unintended consequences as responses, blowing up their expectations and narratives one by one. This loss in Creditibility ensues a collapsing order especially one build upon piles of lies, debt and ego.

When we trade we don't trade for EGO, I am amazed with the Stupidity out there. The underlying positions in reality should mean nothing to an investment manager, what counts in reality is the pips in between, so as a trader the underlying assets mean nothing, right now there are so many funds under water and still hoping for the market to turn around and go to an environment as before, it ain't gonna happen and it ain't matters, a trader is one who has to adapt to every curve, like the sailor which is in me.

You win some ground and you lose some, you drift away by the current, many things could haopen! But when the time comes to move and you ain't moving then there is something wrong, you have to identify what is that and fix it on a bounce. Many people have much misconceptions of what makes a successful career in speculation. Your net asset value has to always be benchmarked to the overall trend, if this ain't happening you have a leak somewhere in the boat, purge this on the bounce. The foolish do additions averaging lower against the trend and they do so everytime, the consequences of EGO, the american retail public now owns most stocks than ever at the peak, inflation is breaking half centuries high and debts assets underlying do not match by a huge significant margin. The debts can never be repaid. War and Recession Amid High Inflation, often follows. Never make investments with any manager that doesnt provide benchmarking or is accountable. Which in our instance is most governments.

Growth is not Inflation. Growth peaked long time ago!

The greatest fools of our time are the current millenium generations for whom I have very little positive words to say but curse the baby boomers generations, who spoilt all of them and the government made matters even worst, by lowering educational standards, student loans and the spring up of "Degree Mills", who made students to memorise some text books but gave them no actual experience and they too are to blame by pursuing multiple degress without disclipline and follow up experience. The consequences Crypto Scandals, Lots of Debt, Zero participation in productivity. This year we shall also see huge withdrawals from baby boomers and this may continue for a couple of years, they are sizing down and withdrawing their cash from the pensions, the pensions on the other hand do not have the money once the market plunges further down.

They have no experience about bear markets and now its their turn. Especially Millenniums. They have zero knowledge in person of everything, they are your post mobile phones generation, they don't know anything much about before and all they know is what drives their attention and such attention is filled in every room, inside government, inside the sec, central banks and these folks are managing the affairs of almost eight year olds, this is a disaster happening right now. Do not Invest with any Manager who cannot ARREST the DECLINING trend of VALUES (NAV) and bring back the account back to positive growth, otherwise there is a risk of losing everything!

I don't think anyone should invest in a manager who doesn't provide positive returns above inflation and above the directional trend. The market is full of them. To beat inflation you only need one asset, that is gold. In the past week it was announced India doubles taxes on Gold Imports cause the last two months purchases of the physical were in far greater amounts. China and Russia gold is been collected by them, eventually who is backed by gold his currency always streghtens and the opposing currency loses value and suffers high inflation, thats how weimar republics are made by loss of confidence. If you don't get your money out of stocks you will never be able to outbeat inflation. Almost all accounts of Bulls are underwater now, the pandemic lows run and the 2018 move where the market didn't have a 1% single down day for more than 200 days signals only one thing, Manipulation. GREED, CORRUPTION.

Which makes the prices you are seeing not real. For Instance every intervention by governments have actually caused prices to be misplriced, this is the situation. For Example with India raising taxes on Gold, it tells me the rupee is going to collapse for the similar amount, what intrigued me is why the Indian Government was doing so? When I dug in further the data came back they had HUGE gold purchases imports in the months of April and May, this is similar to a situation of a Bank Run, reflected by HIGH INFLATION.

The underlying asset value then becomes the question. Whether they have the ability to pay up Debts? Those assets if tained by corruption and wrongly priced which in many instances are and if there is no taker nor buyer, how do you then value such an illuquid yet valuable asset? You make your own price and all Soverigns do, then once above the painthreash hold the mispricings gets exposed, this is your current day JAPAN and this is also for various corrupt countries central banks, this ensues a Bank Run on almost all Pension Funds. THE PANIC of INFLATION. .

The Signs of Which are Ominous!

The markets remains broken. If you are looking at WTI Crude price on CME and think its the actual price of where the market is at or should be. Crude and Gold just did a big manipulative shorts and prices are down. But those are not the real prices of the market, Russian Prices you wouldn't really know, nor of the other bloc. You only the know the price your people are paying at their respective pumps, for their food and other bits of Inflation. The London Metal Exchange didn't honour their positions on Nickle, what does this essentially mean! They are insolvent, so trade will eventually move elsewhere. So the prices of Oil and Gold are actually in premiums/discounts to whats on your watch. Market is manipulated at al the extreme by all soverigns and their governments are alongside involved in that. All long and Wrong at the same time.

Air Pockets remain ahead when they will be looking to sell in a bidless market.

They brought this crash upon themselves.

The Bear has them by the balls type of Scenario is playing out. The move that began from the 2009 Lows of the great financial crisis has now peaked and the market is looking at been 60% lower with a target of low 2000s and carries maximum potential bearish possibilities. A super cycle of sorts begins. An empire is folding and the entire western societies are going bust at the same time. The peak of 3300s and a big collapse to low 2000s brought the last bit of money in, accustomed to high gains without RISK, Powell created a Put, each time the market would fall, he would go long. This Peak is spectacular, it pushed capitalist greed to the extreme into scandalous zones where the entire world was shutdown and turned on the print machines, meme stocks roll where bankrupt companies were worth a couple of billions in days and the world richest man would change by stock prices per day, who would be the next trillionaire first and how to mine minerals in space were the talk of town and all of sudden in a matter of six months everything changed and especially when everyone is so bullish and wrong, the hope remains. This is where we are now. The hope to return as it was yesterday.

Our entire structure of societies is built on Trust!

Credibility allows treasury to operate banks, issue stock.

Once credibility is lost.

One goes bust.

Since the first LTCM bailout. Nothing's changed for the central banks except now Inflation. What the LTCM low did do was to expose the lack of creditibity of Western Nations and their respective central banks, the world was just getting connected, the year 1998 Bailout we are talking about, its at this time the First Bailout costs only 3 Billion Dollars and an agressive rate cuts by GreenSpan and the market turned from the 1998 lows and Nasdaq from a thousand to five, this instance is similar to what happened with us now.

The pandemic lows did the same thing, this time the federal reserve was active alongside and hence the gains were also massive and easy. This all has changed now. Any further print will reflect directly in inflation and this inflation is eventually going to collapse the econiomy of Western Nations further, Italy is already in total decay, not sure how it got there, its a mess of High Debts and Stagnating Economy which is going on there, this situation is now going to reflect across the entire european zones and european countries are going to revolt against the European Central Banks, what are their pain threashold and what size of debt they have. This is eventually going to make europeans pick sides. Looking like Euro could also collapse as A crypto coin. Market is looking at par to the dollar and much below.

the powers they behold given the size of their economies and population and this also exposed the corruptive behavior of their intentions. This is what woke up, CHINA and later RUSSIA.

In the 1997 Asian Financial Crisis when Indonesia and Suharto were on their knees, what did the IMF do? Its now doing this to Pakistan, draconian measures of taxes to destroy the Pakistans Economy and then exploitation of a Slave Country mirred in debt activity begins. Then for Indonesia they they said "Bailouts will bring Zombie Companies, it destroys growth!" Yet when a year later LTCM broke. The FEDERAL RESERVE CUTS RATES AGREESIVELY and did a LTCM bailout, creating the conditions of a Dot Com Bubble. See the. Chapters here: Hope | Fear | Greed . .

In the LTCM bailout the game of Bailouts began. They broke their own rules and now have a Zombified Economy, dependendant of Food Stamps and Subsidies. Today its NO more kick the can down the road moments, they just cannot occur. INFLATION has arrived. For Greenspan was the last best Federal Reserve Chairman, he was blessed with Rapid Adaptation of Technology whose efficiency brought about a Short Term Disinflationary Affect. The Forgers have now maxed up, the era of Higher DEBT GDP SPEND game is practically over, each print is now directly reflected in INFLATION, Erdogan, Venezeula, Argentina all knows best the rest of the world is now finding out.

Powell and Most Central bankers are so so far off the cuff they actually do not know what they are talking about, just think about the mass cognitive dissoance in society where the markets are trading on illusionary dot plots and making Up's and Down's of Hope.

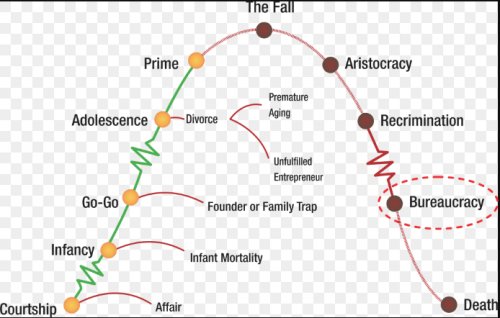

Price Discovery is long dead! The entire stock market is trading on expectations which have yet to be re-rated lower. Note even global population is in reverse since 2019. What other growth factors are there? Its a shrink that comes next, which no one can afford, especially when they are insolvent and bankrupt. Corrupt Breaucrats have raided everything, including the pensions funds, just no one can accept money in reverse. They can't afford it, it makes them go Bust. See:

Curve Fitting the data - The greatest folly and the search for the Holy Grail.

Let me explain. Today the market is totally a Farce. Every action by central banks or governments delivers a response in reverse, the cause of that is their constant interventions in societal affairs, fiscal responsibilities and in governance has been corrupted due to "selfish bias" to maintain their own narratives. When this happens the system breaks down, here is why! Their operations are not forward looking but reactionary as they try to save their own arse.

Their systems started breaking down when they became reactionary to infuse "selfish bias" as they in desperation had to create regulations surrounding "Freedom of Speech" online with their laws on "Fake News", with that independent real reporters went into a frenzy and then they were forced to purchase failing media companies, Mr Gates has spend close to 450M dollars over the pandemic to keep a good narrative ongoing for him while he tries to corner the farmland market, his monopolitic nature first in Microsoft, whose OS he acquired for fifty thousand dollars, trading his way with IBM, he remains a monopolistic creature, financing the pandemic prepardness, registerering of IPs and bringing together various groups to prepare to what was about to unfold, this event then gets the attention of the world economic forum and they too jumped right in, See Event 201 here and See the grand plans of the architechs of the Great Reset.

The Failure of all past operational systems and structures surrounding them have been like a house of cards when the slippery slope begins and this happens because of their own "interventions". They forgot the rules of operation, with AMENDMENTS and now they do not know what works and what doesn't, the consequences of this mismanagement are TAXES and BAILOUTS. Right now the population is suffering, mainly caused by lack of leadership, lack of honest leaders, lack of ethics in the general population. The population too went "all in", believing in their Politicians piped dreams, when inflation arrives growth gets exposed such are the conditions now. The narrative now is reverse. This is a very big problem.

On one end governments are attempting to show passion and care towards the population but the main motivation is to cover up their own scandalous schemes. There America add sanctions and raids its own OIL RESERVES but still PRICES are higher at the pump. They have to beg Venezuala and Saudi, whom they wont even want to meet Blinken, let alone Biden, who is facing court cases on his Ukraine Hunter Biden Scandal.

This current Bear is here for vengeance while its obvious everyone is caught long, the last to correct the imbalances of the long lost due correction and to remove the excesses and fat which are now inherently build into the system, the pandemic lows practically roped in the last bit of Money, the money of the greatest fools. For your kind recollection in March 2020 the SP500 traded as low as 2230 and recently in December we made new record highs at 4882. If you haven't paid attention then there is no greatest bearish moment in our history. The cycle bust is for a significant degree, some refer to this as "the Fourth Turning" whilst others refer to it as "The Great Reset".

As a technical analyst studying price patterns and changes for over the last 30 years and trading all bear markets since then, starting with the Soros pounds crash of 1992, What we have now reflective is the most bearish signal for a crash. This time there isn't Federal Reserve Put. This gig is up. .

The Bear is here with a Global Recession it Panics in Fear Amid Food Crisis Collapsing Governments everywhere.

This too has happened many times before. Read Gibbons Collapse of The Roman Empire. This collapse is historical and spectacular, the folding of the accidental empire concludes. The activities of the last past week is sufficient proof, more than half of the world is divided into another groups, the western sanctions have backfired and its hurting none other but them, those who trade into Indo-China-Russia camp has most majority. The effects of which are indeed spectacular, looking at the last six months, US Mortgage Rates have Doubled. The Dollar is on a tear not as a safe haven but with lesser dollars in circulation as countries are umping hands over fist US Treasuries, the US is no more an Empire which can restore peace nor order, its corrupted itself right to the core, the scandals of fauci and the big pharma industry is only surfacing and Biden has just placed another order for Pfizer at above 60^ higher than previous value. This is a recipe again for disaster.

........ to be continued.

Disclosures: Bearish Bias. This is the theisis. And I am revealing this to you! But before that let me give you details to make you understand how I came to these conclusions. Some background info. By training I am a Investor and a speculator and having speculated for a living for over three decades, travelling and living from country to country, living and understanding social economics and trends in all these zones, sooner or later I was able to realize an amazing phenomenon, it's called a trend, a directional bias of regression or prosperity, societies everywhere we're heading into similar conclusions, sooner or later. The Bulls are slaughtered having lost memory of a Bear Market. Go grab your popcorn there is alot more on this site. Stay Tuned and Ahead of the Curve. Previous Archives. DynamicTrader.com - Trend Trading Dynamics Since 1998. All Rights Reserved.

What's Your Reaction?